Marketing technology buyers are results-driven and often choose vendors that are leaders in their field. A good reputation within your industry puts you in good stead, but truly engaging with prospects takes a measured approach with great communication and even better content.

If you want to reach the right people, generate leads and convert these leads into sales, it’s crucial to know how your audience think. How do they plan their budget? Where do they go to research solutions? What information sources do they trust to aid their decision? And not forgetting, what challenges do they face?

Understanding customer pain points is key when it comes to knowing what content to share. Then knowing who to share the content with – and when – is the critical next step. Because when it comes to selling to today’s modern MarTech buyer, there are multiple factors at play. Our latest research pulls together essential data about the way decision makers reach their outcomes, giving vendors and demand generation managers the inside track.

Combining survey data and marketing technology readership stats, we can deep dive into the mind of your buyers and teach you how to reach, engage and convert Marketing technology buyers.

Reading time: 10 minutes

Survey sample

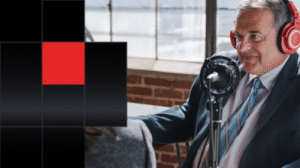

Our sample includes 250 senior leaders working in marketing, located across the USA and the UK. All survey participants play a part in technology purchasing decisions for their company.

We surveyed large companies with 500+ employees. Of the sample mix, a third have up to 1000 employees, 42% (the largest group) have up to 2500 employees, 16% have up to 5000 employees, and 9% have over 5000 employees. An even mix of authority levels were included in our sample. These were department heads (12%), senior managers (22%), company directors (32%), vice presidents (23%), and C-suite decision makers (11%).

Over a third of survey participants said they are involved in over 10 purchases per year for their company. A small percentage (7%) said they are buying in high volume, with 20+ purchases in a typical business year.

How marketing technology buyers plan their budget

Great content should be at the heart of every demand or lead gen strategy. But understanding more about how (and when) your buyers plan their budget is critical to making your content a success and engaging marketing buyers. It’s about solving customer pain points in the right phase of the cycle. Our data sheds light on the process.

When do they plan?

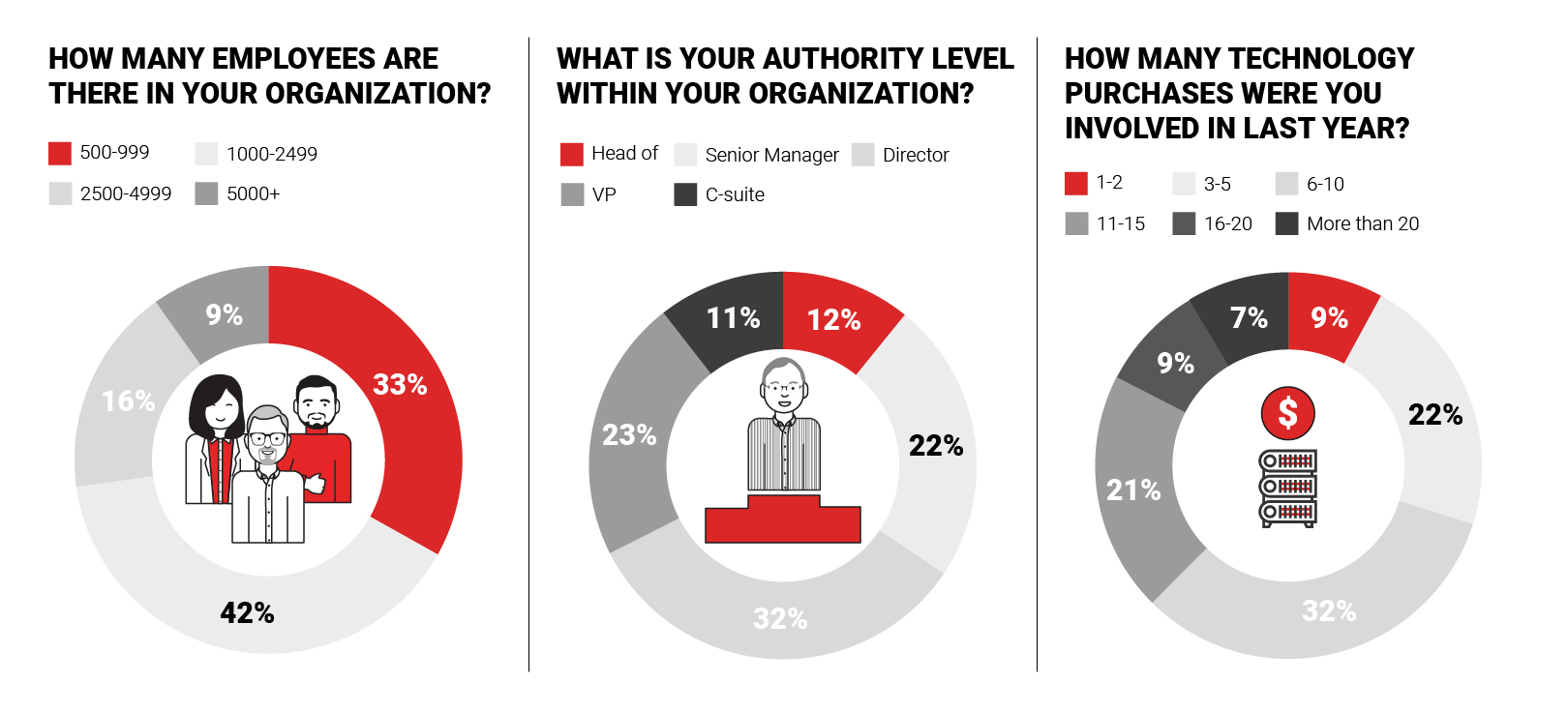

According to our survey results, over half of buyers are doing their budgets annually. However, almost 30% are doing theirs on a quarterly basis and 17% are doing it on a project-by-project basis.

How much are they spending?

A large 63% are dedicating over 25% of their total budget on tech for the marketing department. Almost half (47%) are allocating up to 50% of total budget, and 15% are allocating up to 75% of total budget. Putting that into monetary terms, our survey reveals that almost 60% of businesses are spending over $250,000 on marketing tech each year.

This shows great buying power from marketing departments that are looking to elevate their success and increase conversions. Technology not only saves time, but it can help businesses tap into valuable customer insights – making marketing tech a great investment that delivers on ROI. As a result, the majority of companies are willing to allocate a large chunk of their budget on it, with some buyers (12%) investing into the millions.

Additionally, a huge 90% of buyers admitted to spending more than they expected in 2019. This shows the scope for driving demand and increasing sales through solving problems they have.

How will they spend in the future?

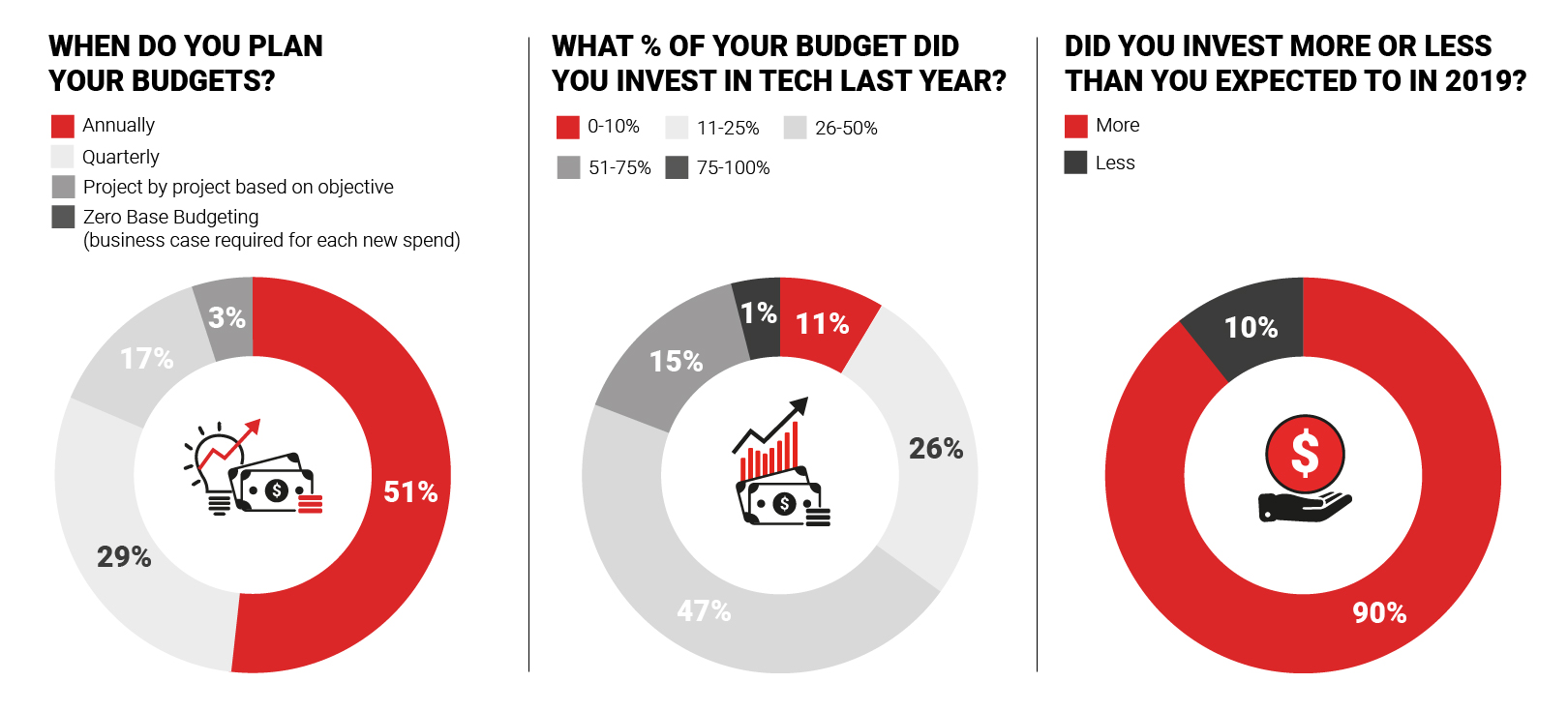

According to our stats, the same buyers are looking to spend just as much in the coming months, with an impressive 98% saying they will spend the same amount or more. Of this group, 70% are definitely intending to increase their budget.

If we take into account that 90% ended spending more than expected in 2019, it could indicate that increased budgets could be significantly bigger than buyers have forecast.

A closer look at the decision makers

Another key to success in nurturing the funnel with MarTech buyers is understanding exactly who is influencing decisions. Often, there are multiple stakeholders involved in the buying process, so for sales teams and demand gen managers, it’s important to reach decision makers at every level – not just the top or just one particularly job role.

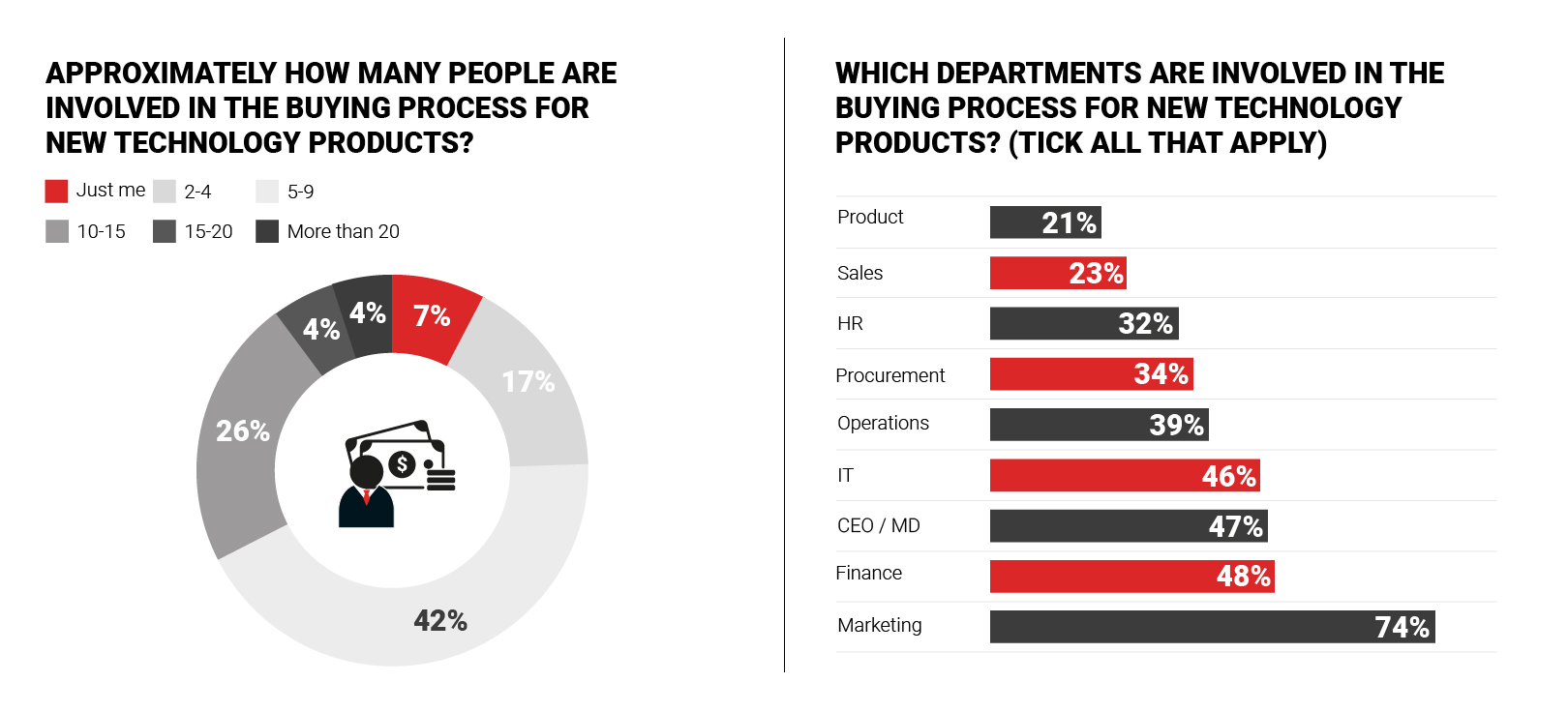

How many people are involved?

Over three quarters of our survey respondents said that 5 or more individuals are involved in the buying process for new technology products in their company. Only a small 7% of people said they handled buying decisions alone.

Who are the decision makers?

When selling to marketing technology buyers, it’s important to look beyond just the marketing department. While they have the biggest stake, other teams appear to be just as prominent in the purchasing process. The ones that seem to matter the most according to our survey are Finance, IT, Operations and Procurement, as well as board members such as CEOs and MDs.

Other departments that are involved to some degree include HR, Sales and Product teams.

The diversity of decision makers reveals the need for a varied yet targeted approach when it comes to content. Vendors need to create useful and relevant content pieces for buyers at every level, from department heads to the CEO. Simply focusing on the main decision maker could be a mistake, leading to a loss of confidence from other departments that also play a pivotal role in purchasing. An inclusive content strategy needs to be in place, and buyers from all departments need to be nurtured through the funnel with multiple touchpoints across the buying timeline.

How buyers do their research

When it comes to researching the right solutions for their business, buyers will use a wide variety of sources to gather information. Our survey dives deeper into their most trusted data sources and how much research they do before they come to a decision.

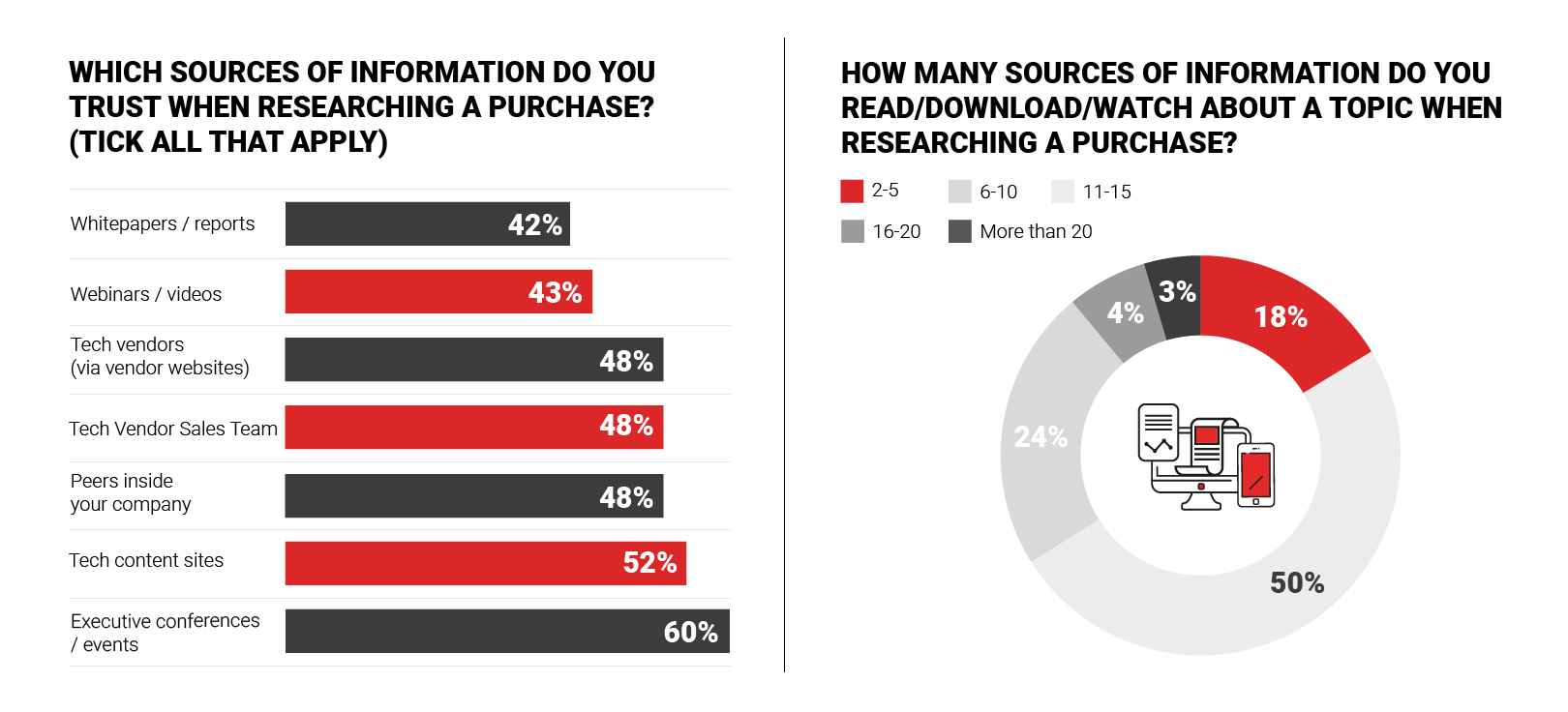

What content do they trust?

Our respondents appear to use a range of methods for learning, with the most preferred way being events and conferences. This is followed by very closely by tech content sites like Insights for Professionals, as well as speaking to peers within their own company, getting information from vendor sales teams, and using vendor websites.

The face-to-face nature of live events makes it easier for buyers to get a sense of suppliers and should always remain a part of the B2B sales strategy. However, in today’s climate with global health issues still lingering over us, businesses will be relying on content sites more than ever.

Webinars, videos, whitepapers and reports were also highlighted by our respondents as trusted content. This shows that having a solid content strategy in place is essential. Tech suppliers that want to connect with their audience and engage marketing buyers should populate their own websites as well as take advantage of content hubs, like Insights for Professionals, that have a large readership of senior IT and marketing professionals.

How much research do they do?

What is abundantly clear is that the majority of buyers conduct extensive research before following through with a purchase. A tiny 1% of respondents said they would trust just one source, but 92% turn to 6 or more sources in order to make an educated decision.

Content calendars need to include a range of topics and angles, and multiple publications should be used. The more expert content vendors can get out there, the better their brand awareness. And instead of selling their products, tech companies should focus on providing valuable advice as a part of their inbound strategy.

The buying trends to know

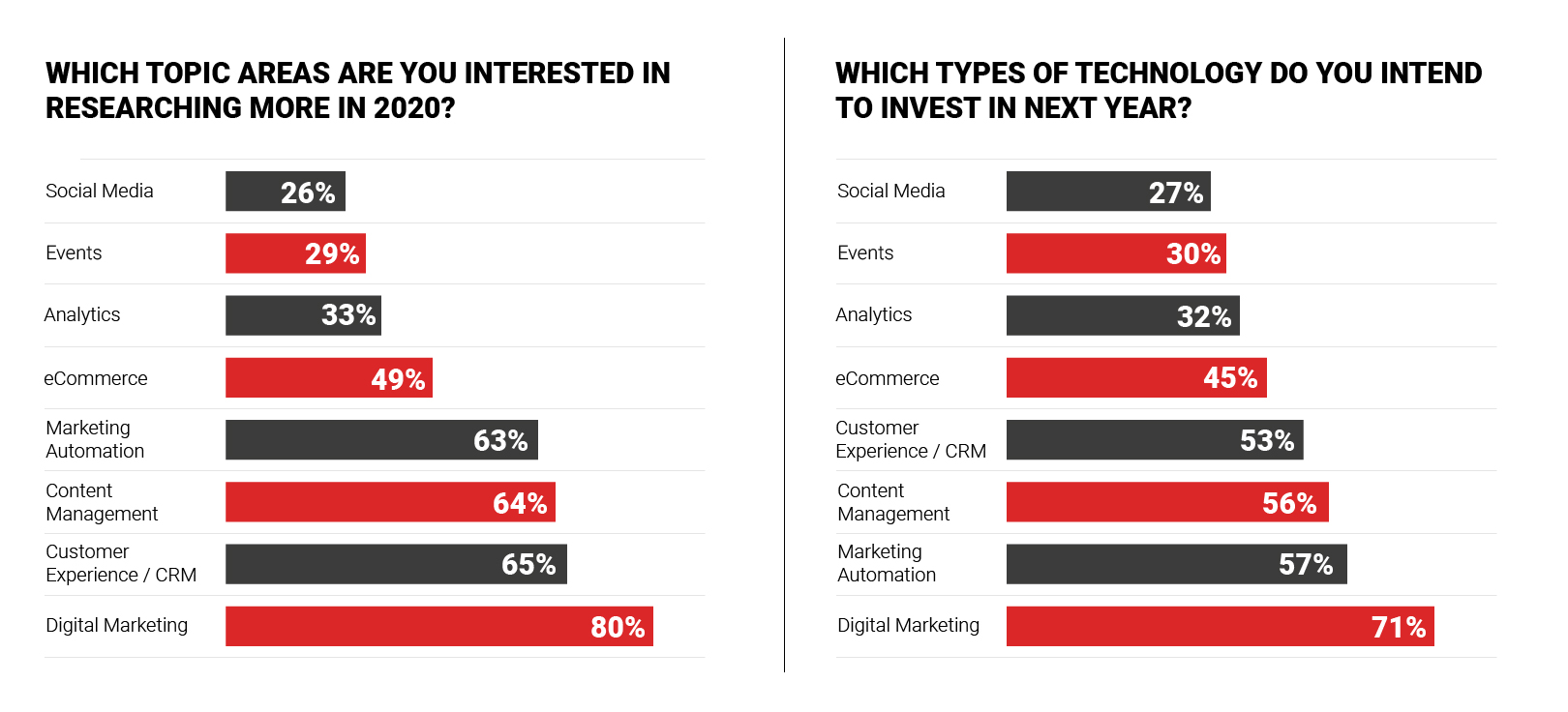

Being able to answer buyer pain points starts with knowing what they’re interested in. Many buyers want to save money, boost efficiency, increase sales, hit targets and grow their operation. But how are they looking to achieve these things?

Our data reveals the most important themes to them right now. According to our survey, buyers show a keen interest in the wider topic of digital marketing. Additionally, they are focusing specifically on customer experience (CX) and CRM, content management, and marketing automation. Other areas that pique their interest are eCommerce, analytics, events, and social media.

With CX being one of the most important topics of discussion, this could show a growth in tech trends such as mobile apps, content platforms, multi or omnichannel tech, AI, voice search, and personalization. Content is a major theme for decision makers too, making lead generation and automated tech big areas of focus.

Many of these themes also overlap. For instance, content management and automation go hand in hand. As do CRM and customer analytics, or CX and social media. Looking at what our surveyed buyers are interested in next year, the top themes remain the same, with more focus on automated technology and content still remaining a priority.

Buying timelines

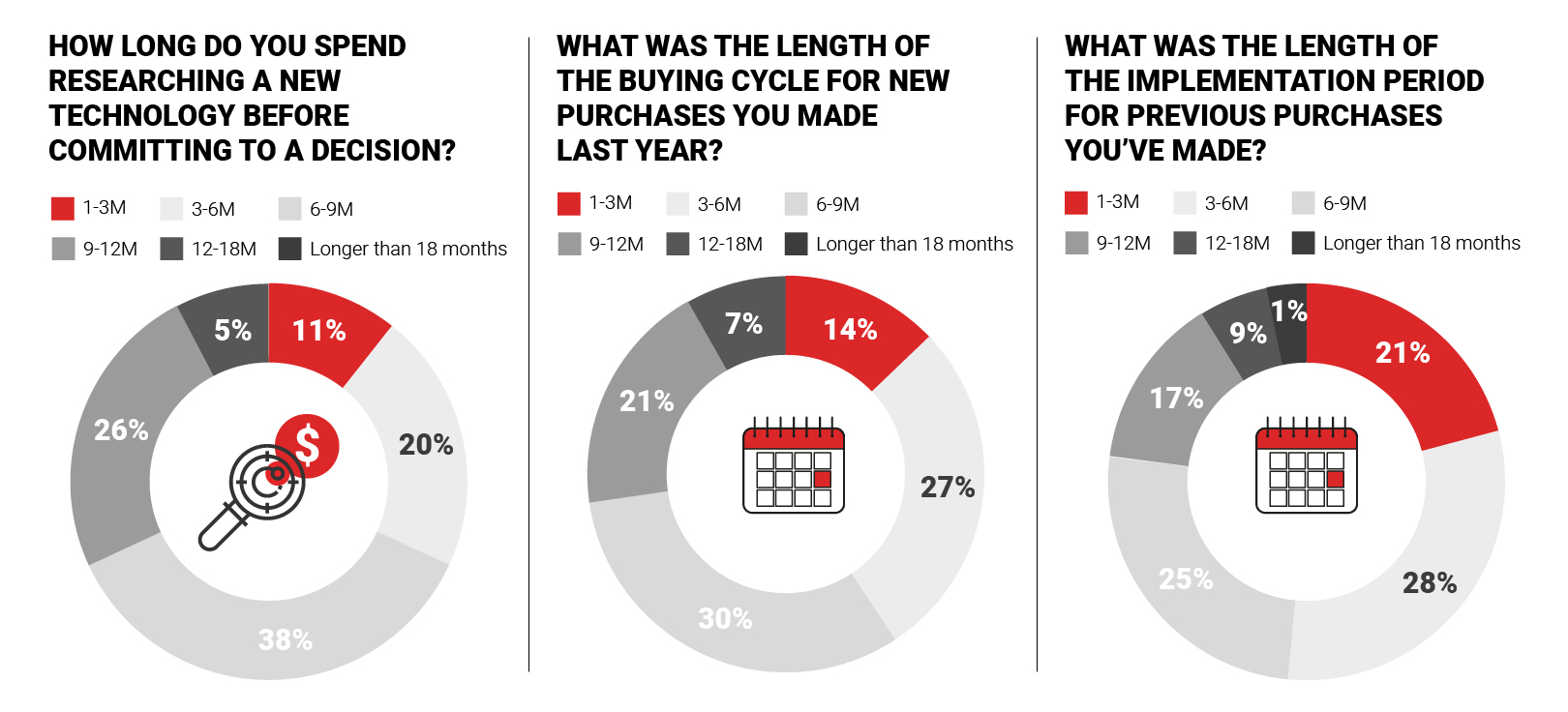

As well as knowing who to reach and what type of content to reach them with, vendors must also be aware of the buying timeline. The typical process can be a lengthy one and this is often due to the extensive research involved, the number of stakeholders in decision making and the complexity of deployment. Because of the different factors at play, timelines can vary from company to company.

What we can ascertain from the survey data is that over 90% of all organisations complete each stage within a year. The three stages we are talking about are: research, buying, and implementation. Now let’s break them down for a closer look…

Research stage

95% of organisations complete the research stage in under 12 months, with a large percentage (38%) dedicating between 6-9 months to their research time.

Buying cycle

Similarly, 93% of respondents complete the buying cycle for new purchases within the year.

Implementation

Exactly 90% complete the deployment of new technology in their business within 12 months, with over half completing within 3-9 months.

There’s a clear pattern to note, as most companies are ready to complete the whole process within 3 years, but many move things along much faster. Only a small percentage go over this timeframe, which could be due to factors such as funding, technical complications or uncertainty from stakeholders.

Challenges to solve

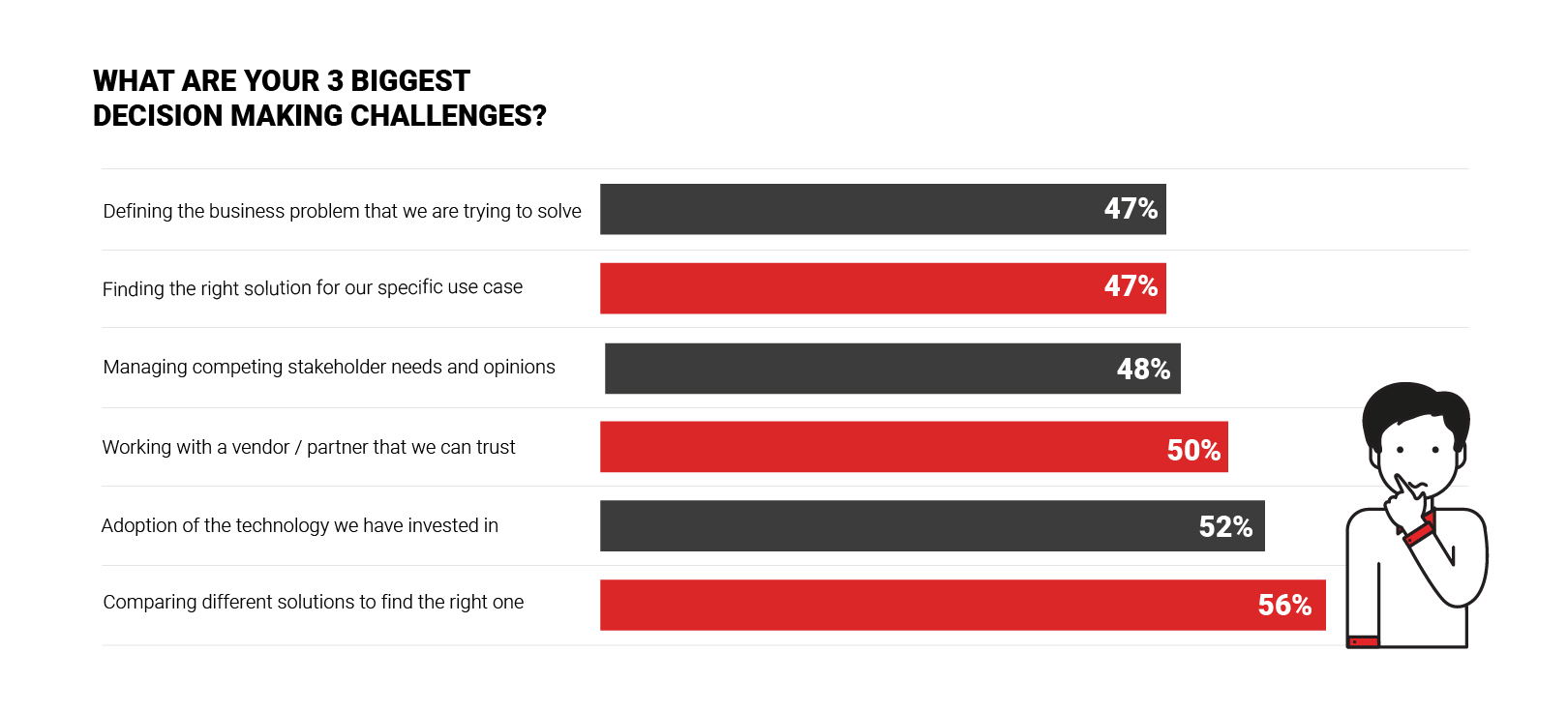

Buying new technology products for the marketing stack comes with a number of challenges. This is often because of the growing knowledge gap that exists within companies when it comes to new technologies, so content hubs are essential for getting businesses up to speed.

Deciding between different solutions or finding a partner that they can trust are clear challenges for our buyers, as seen in our survey results. But other problems that exist include being able to manage multiple stakeholders, adopting technology in the right way, or being able to clearly define the business problem in the first place.

Vendors play a pivotal role in helping buyers overcome these challenges. In order to successfully manage stakeholders, content plans need to answer to different needs and align with various business goals (sometimes conflicting ones).

There also needs to be continued customer care throughout the entire timeline, and knowledge from the supplier about effective change management. Communication is key here. Plus, helping decision makers better understand what it is they are trying to solve can be alleviated through studies, stats and reports. Numbers and real life uses cases are easy for buyers to relate to – and this means they can apply the results directly to their own operations.

The final outcome

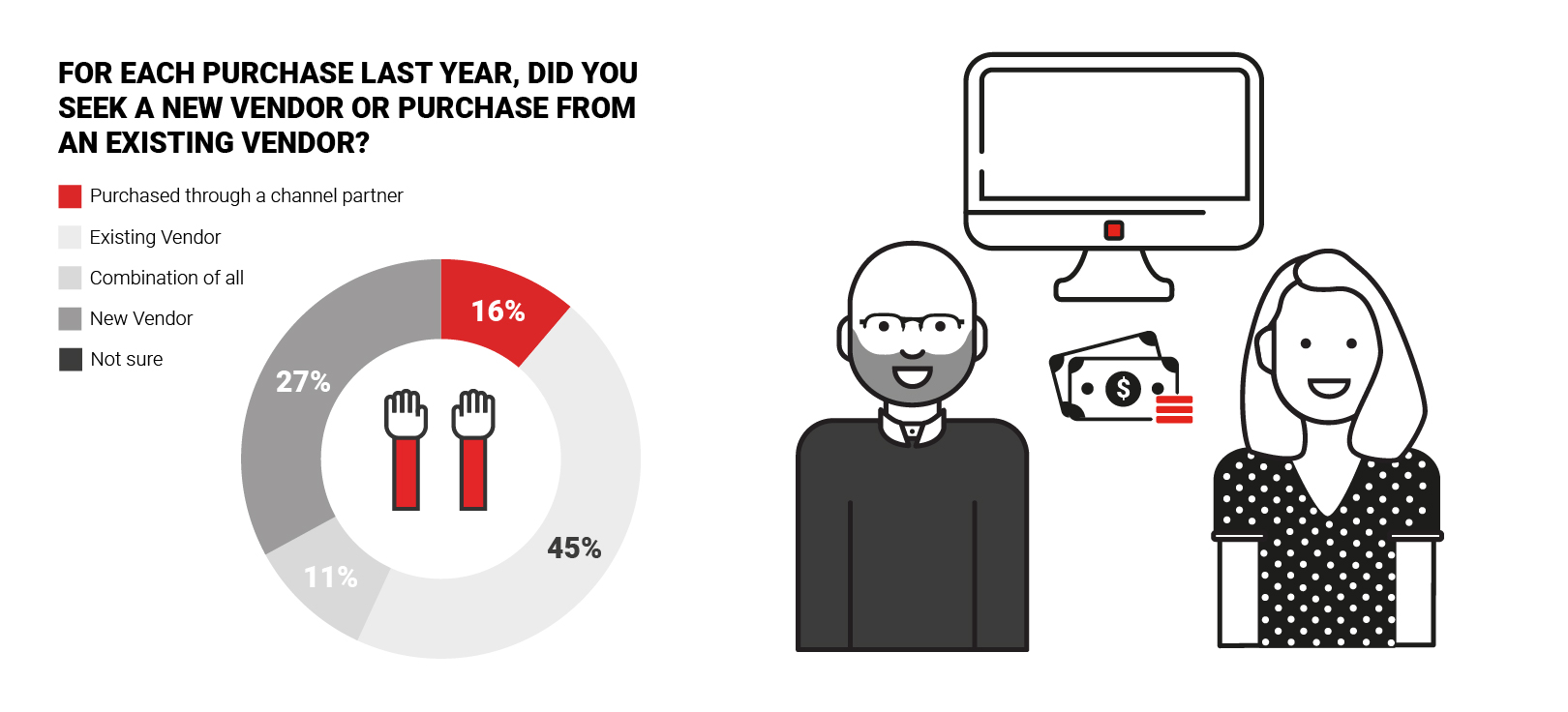

What has been the most interesting discovery in our survey is the final outcome at the end of the purchasing process. Not only were the majority of marketing buyers we talked to very satisfied with their tech purchases, but they showed a certain loyalty to existing vendors they had worked with before.

With 45% using an existing vendor for new tech purchases, there’s huge scope for suppliers to re-establish relationships with old accounts. At the same time, the data shows promise for new vendors as over a quarter purchased through a new channel partner. More significantly, our data tells us that MarTech buyers are largely happy with their outcomes and the results achieved for their respective organisations.

Expectations vs. reality

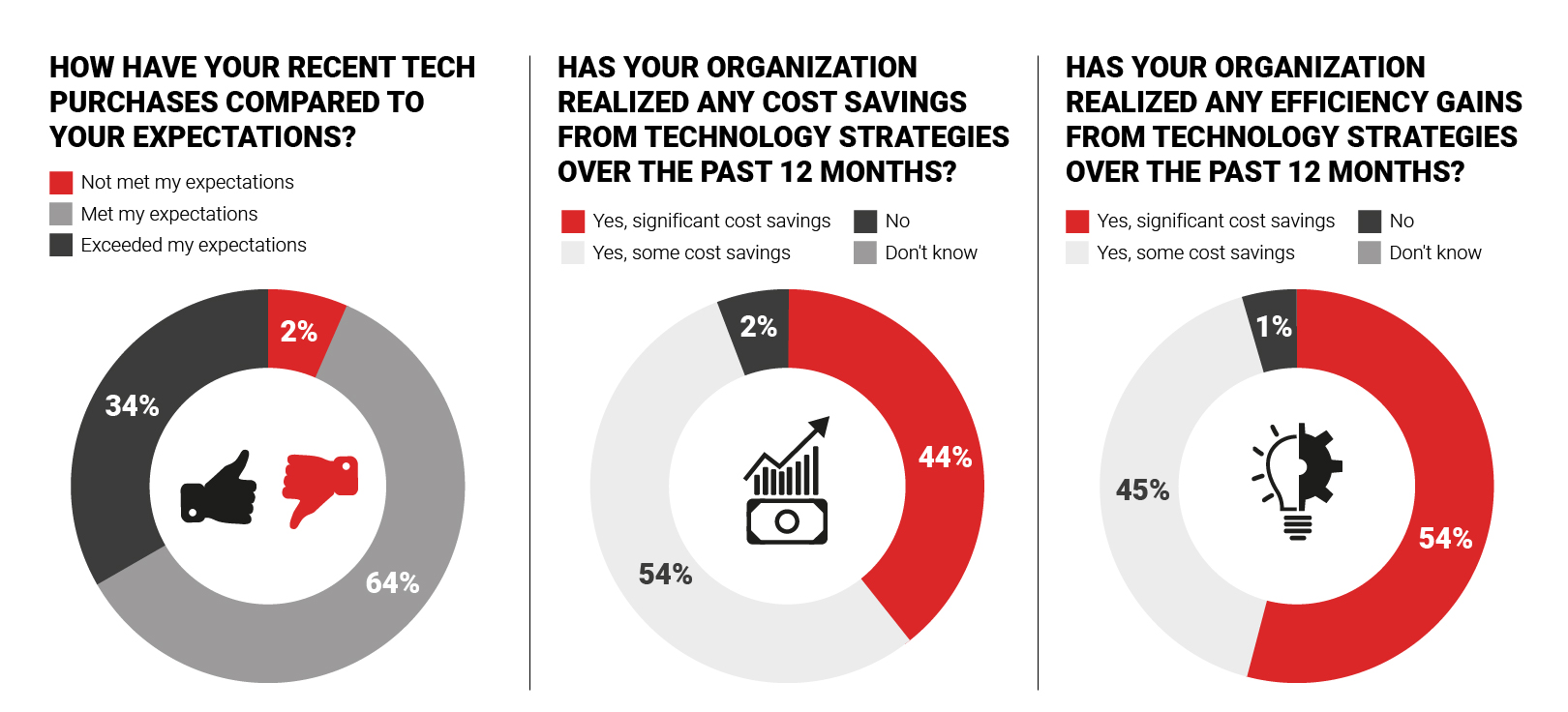

An impressive 98% said that tech purchases have either met or exceeded expectations, with over a third stating the latter.

Cost savings

In terms of cost savings, the same number (98%) said they had managed to cut operational costs. Of the group, 54% made some cost savings while 44% made significant cost savings.

Efficiency gains

A similar result was seen for efficiency. A massive 99% saw efficiency improvements in their department or business. While 45% saw some efficiency gains, an impressive 54% saw substantial increases.

It is clear from our data that technology is hugely beneficial to marketers, and investing in the right solution is something that takes extensive research. To build confidence in buyers, tech vendors should include client case studies to highlight the cost savings and efficiency gains. This sort of data will augment any existing content strategies, appealing to results-driven buyers and their faction of stakeholders.

With outstanding levels of customer satisfaction seen in the industry, tech companies have huge opportunities to reach, engage and convert leads. And at the heart of every strategy should be a considered content plan to connect with and delight buyers along the funnel.