Business growth is a struggle for even market leaders at times. If you are a challenger brand trying to grow in your category it can be even harder. Recent studies highlight the gravity of the situation, with an 18% decrease in win rates, a 21% drop in deal values, and a 16% increase in sales cycle length. Additionally, nearly 70% of reps missed their quotas. These challenges underscore the urgent need for marketers to adapt and refine their demand generation strategies.

As sales pipelines become more complex, it’s imperative for marketers to rethink their approaches. Traditional methods are no longer sufficient to address the multifaceted nature of today’s buying behaviors.

This blog provides a comprehensive framework to help B2B marketers overcome these hurdles, enhancing their demand generation efforts to drive growth and achieve their revenue goals profitably through efficient planning.

Rethinking the traditional demand generation funnel

The conventional demand generation funnel has long served as a roadmap for guiding prospects from awareness to purchase. However, modern buying behaviors have evolved, rendering these old models less effective.

Today’s buyers embark on extensive research, engage with multiple stakeholders, and interact with brands across various channels before making a decision.

For instance, according to our recent study, 50% of B2B technology purchasing decisions now involve 8 or more stakeholders. This shift highlights the growing complexity and collaborative nature of B2B purchasing, underscoring the need for demand generation strategies that resonate across a wider array of influencers and decision-makers.

Additionally, the extensive time invested in research further reshapes the demand generation approach. A significant portion of B2B buyers dedicate 3–9 hours each month to researching new technologies, while 23% invest 10–19 hours, demonstrating a deeper and more prolonged engagement in the decision-making process.

To capture the attention of B2B buyers as they research, you need to take a dynamic and flexible approach to demand generation activation, one that provides valuable, relevant content throughout the buying journey. Effective B2B content marketing is essential in delivering this value, helping to engage prospects and influence their decision-making process.

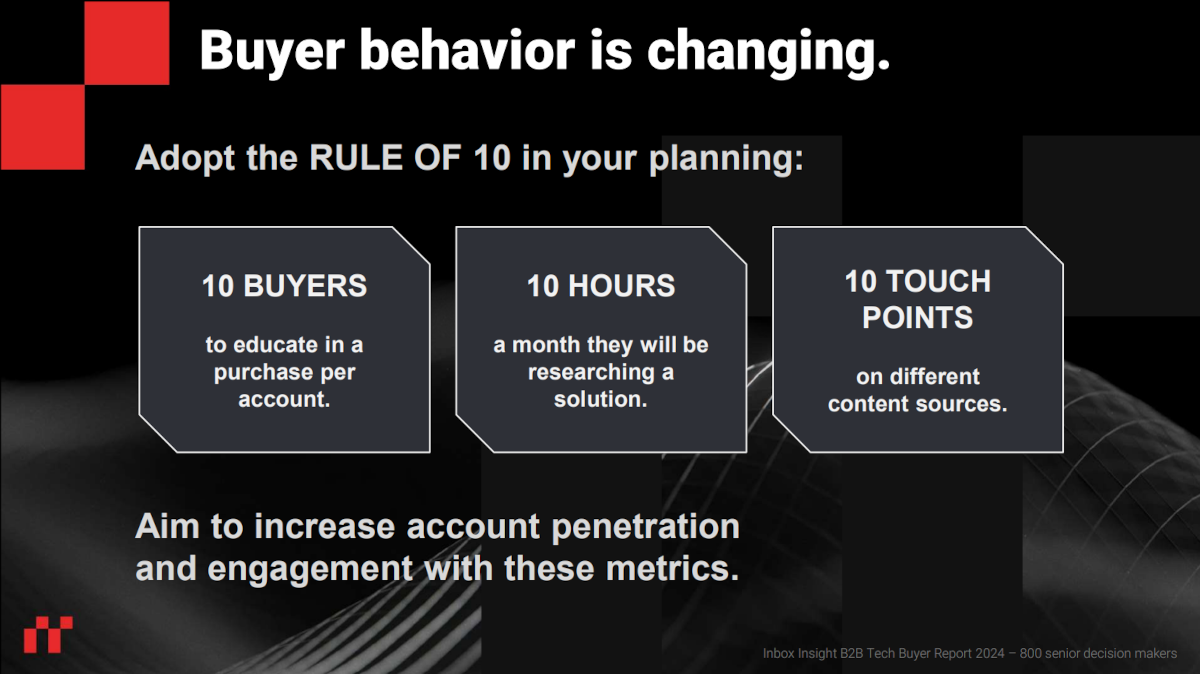

The rule of 10 in B2B buying

Understanding the complexity of B2B purchasing processes is crucial. The Rule of 10 encapsulates this complexity:

- 10 Buyers per purchase decision

- 10 Hours of monthly research per account

- 10 Content Touchpoints across various platforms

This principle highlights the necessity for deeper account penetration and engagement with multiple decision-makers. Effective demand generation strategies must account for the diverse influencers and the extensive research involved in B2B transactions.

Key takeaway

Modern demand generation requires a nuanced understanding of the buying process. Engaging multiple stakeholders and providing value at each touchpoint are essential for driving successful outcomes.

Building your revenue engine by working backward

Defining revenue objectives and working backwards

Successful demand generation starts with clear revenue objectives. By setting specific revenue targets, marketers can reverse-engineer the necessary pipeline requirements to achieve these goals. This approach ensures that all marketing activities are aligned with the overarching business objectives.

Sample calculation framework

Begin by outlining your target revenue and determine the number of deals needed to reach this goal. From there, calculate the required number of leads at each stage of the pipeline, considering conversion rates.

This structured methodology provides clarity on the volume and quality of leads necessary for success.

Everyone’s conversion rates throughout the sales funnel will be different. Make sure you model these based on real data. Understanding that different leads from different channels will convert at different rates is also important to set the correct expectations with sales. You don’t want to be in that situation where Marketing has hit the right number of leads but sales misses target, and fingers start being pointed…

Ross Howard, Product Marketing Director

Understanding unit economics

Grasping unit economics is vital for efficient budget allocation. Metrics such as cost per lead (CPL) and cost per sales accepted lead (SAL) help in assessing the financial efficiency of your campaigns. By monitoring these KPIs, marketers can optimize spending to maximize return on investment.

It also helps you factor in how many touchpoints you can deliver to each lead or account within the number of SQLs you need to hit target.

Aligning CPL and Cost per SQL targets with revenue goals is fundamental for cost-effective demand generation. By setting clear financial benchmarks, marketers can measure and optimize the efficiency of their campaigns, ensuring sustainable growth.

Reducing wastage in content and ad spend

Minimizing wastage involves strategies such as dynamic retargeting and content localization. Adapting content to specific stages of the buyer’s journey and tailoring messages to different segments ensures that marketing efforts are both relevant and efficient. Optimizing spend in this manner maximizes the impact of each dollar invested.

Intelligent account selection: the power of a strong ICP

Defining your ideal customer profile

A well-defined Ideal Customer Profile (ICP) is the cornerstone of effective demand generation. Creating an ABM ICP involves understanding key components, such as:

- Firmographics: Size, industry, and location of the company.

- Technographics: Current technology stack, software, and infrastructure used by the company.

- Buying process indicators: Number of decision-makers and committee size.

- Pain points and goals: Specific challenges and desired outcomes of the customer.

Using CRM data for validation

Leveraging Customer Relationship Management (CRM) and Marketing Automation Platform (MAP) data can validate and refine your ICP assumptions. Analyzing past interactions and performance metrics ensures that your targeting remains accurate and effective.

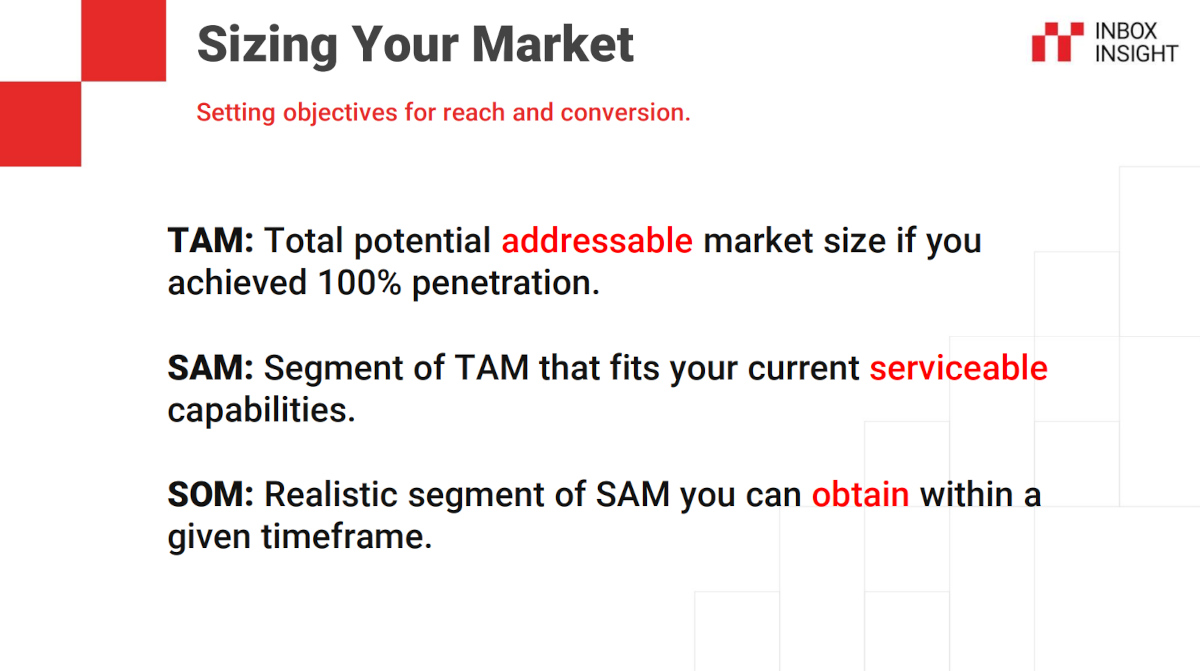

Sizing your market

Once you know your ideal customer profile, you need to size your market to see the reach available into them and judge the possible impact of your campaigns. This means starting from the universe of relevant companies, and drilling down into who you can best serve, and win, right now.

Defining your total addressable market (TAM)

Total potential addressable market size if you achieved 100% penetration.

Market research:

Conduct comprehensive market research to understand the broader industry landscape, including size, growth rates, and prominent trends.

Use both primary research (interviews, surveys) and secondary research (industry reports, market studies).

Revenue potential:

Estimate the value of the entire market by assessing how much revenue the market could generate.

Common approaches include:

- Top-down approach: Analyzing the industry-revenue and estimating your share.

- Bottom-up approach: Summing up the potential sales to every customer and multiplying it by your product price.

- Value-theoretic approach: Estimating the aggregate value of solving the customer problem in question.

Identifying your serviceable available market (SAM)

Segment of TAM that fits your current serviceable capabilities.

Segmenting the market:

Divide the broader market into smaller sub-segments based on geographical regions, industries, customer size, or other relevant criteria.

Target customer profile:

Identify key characteristics of your ideal customer (e.g., company size, industry, location, purchasing power) where you have seen more customer success stories.

Focus on segments where your product/service can fulfil the specific needs more effectively than the competition.

Capabilities:

Evaluate your current capabilities in terms of product/service offerings, distribution channels, customer support, and delivery methods.

Exclude segments where you may not be able to currently provide efficient service or face insurmountable legal/regulatory issues.

Determining your serviceable obtainable market (SOM)

Realistic segment of SAM you can obtain within a given timeframe.

Competitive analysis:

Study your competitors’ market share and their product/service offerings.

Consider the strengths and weaknesses of your competitors and what differentiates your offering.

Market penetration:

Estimate the adoption rate of your product/service within the SAM based on historical data, growth rates, and marketing effectiveness.

Resource assessment:

Assess your sales and marketing resources, budget, and go-to-market strategy.

Align your sales capacity and marketing campaigns to realistic outreach capabilities.

Timeframe:

Define a specific timeframe for capturing market share (e.g., within 1 year or 5 years). Consider growth rates and sales cycles relevant to your industry.

Use the lead follow up time and average sales cycle from your CRM to estimate when you will see returns from your campaign and set the right expectations with the C-Suite.

Don’t overthink it

Planning in this level of depth can be overwhelming, but help is available.

To conduct a thorough market analysis, utilize tools and resources such as industry reports, government databases, and market research firms. These sources can provide valuable insights into market trends, consumer behavior, and competitive landscapes.

Also, a demand generation partner can help you mapping database counts and lead volumes in one process so you can quickly see your obtainable ICP and budget required. They can also help optimize which accounts within your ICP you should be targeting by applying intent data powered tactics.

Using intent data for precision targeting

Types of intent signals

Understanding intent data provides insights into the likelihood of a prospect making a purchase. There are two primary types:

- Proof-based signals: Direct activity related to your product or industry, such as website visits or content downloads.

- Probability-based predictions: AI and machine learning models that predict a prospect’s interest or likelihood to buy based on their behavior.

Tracking and measuring intent

Utilizing intent signals allows marketers to fine-tune their targeting strategies. By identifying prospects who exhibit buying signals, campaigns can be more personalized and timely, increasing the chances of conversion.

Here are some examples of how we use intent data within demand generation planning:

- Funnel stage: The depth of research, frequency of research, how many topics they consume.

- Competitor research: Are they already exhibiting research behavior for a directly comparable solution? If so, get in front of them so you don’t miss out on RFPs.

- Trend analysis: What’s hot changes and how buyers are researching can help you decide on how you approach them, what content to use.

Quick(er) wins

Combining ICP criteria with intent data enables high-precision account prioritization. This targeted approach ensures that resources are focused on the most promising leads, enhancing overall campaign effectiveness.

The common output for this intent data process is the production of a Target Account List. You can use this list of prioritized accounts throughout your different digital marketing platforms, and with publisher partners, to run an integrated campaign.

Running an integrated demand generation program

Adopting a multi-channel approach

An integrated demand generation program leverages multiple channels to create a robust, multi-touch strategy. Combining paid social, display ads, and content syndication ensures that your message reaches prospects wherever they are. This diversified approach increases brand visibility and engagement across various platforms.

In fact, 60% of B2B buyers prefer using software comparison websites for research, with 52% relying on industry news sites. Reaching prospects on the channels they trust most can significantly enhance engagement and impact. 68% of buyers trust impartial 3rd party content more than content directly from the vendors. Mixing in sponsorship of publishers and analysts to co-brand content in demand gen programs can increase trust while achieving relevant reach.

Building a content distribution strategy

Tailoring content formats and channels to different buyer personas and stages of the funnel is essential. For example, educational content may be more effective during the awareness stage, while case studies and testimonials can drive decision-making.

With 51% of B2B decision-makers expecting a high level of personalization in content, a strategic distribution plan that addresses individual preferences ensures that the right content reaches the right audience at the right time.

Nurturing leads through multi-touch engagement

The role of retargeting and lead nurturing

Building a multi-touch nurture program is critical for moving buyers through the funnel. Retargeting helps keep your brand top-of-mind, while personalized communication addresses the specific needs and concerns of each prospect.

With nearly half (49%) of B2B buyers favoring on-demand webinars and 40% attending live, offering varied content formats supports flexible engagement. This dual approach enhances the likelihood of conversion by maintaining ongoing engagement.

Mapping the content journey

Outlining the stages from awareness to decision allows for the creation of targeted content at each phase. Awareness content introduces your brand, consideration content educates prospects on solutions, and decision-focused assets provide the final push toward purchase. This structured journey ensures a seamless transition from interest to action.

Conclusion

Effective demand generation requires a strategic and adaptable approach. By redefining traditional funnels, setting clear revenue objectives, and leveraging data-driven insights, B2B marketers can navigate the complexities of the modern marketplace. Emphasizing account selection, multi-channel integration, and continuous optimization ensures that demand generation efforts are both efficient and impactful.

To achieve demand generation success, it’s essential to remain agile and continually refine strategies based on performance data and evolving market dynamics. By implementing the key strategies outlined in this masterclass, marketers can overcome pipeline challenges and drive sustained growth.

Ready to take your demand generation to the next level? Watch our ‘Live Teardown: An Enterprise Demand Generation Planning Masterclass‘ with Ross Howard for in-depth insights and actionable strategies to transform your campaign planning and execution.